Trading on the international financial markets was smooth until the 2008/2009 financial crisis happened. This crisis led to the collapse of several companies around the world. However, one thing that wasn’t getting the attention that everybody noticed amidst the crisis; identification of legal entities in the international financial market was a complicated task.

Using company names and locations was not enough to create a reliable distinction between the various legal entities. This called for all the concerned authorities to think of a better way of creating a clear distinction between the different legal entities involved in the international financial markets. The Global Legal Entity Identifier System (GLEIS) was created.

How it all happened

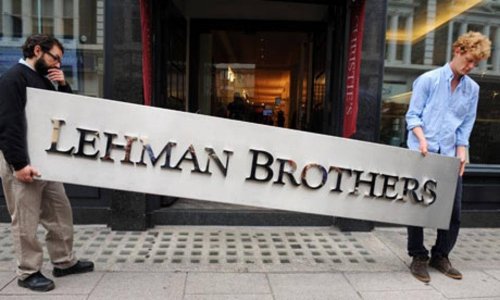

One of the major lessons that we have all learned from the financial 2008 financial crisis is always doing business with an entity you can easily identify. The collapse of the Lehman Brothers (the fourth-largest investment company in the US by then) opened the eyes of several financial institutions because most of them could easily identify this organization.

If identifying such a huge investment company was a complex tax for banks, how about smaller businesses and startups. Getting the full details of the corporate structure of any given company shouldn’t have been a complicated task if there had been an organized system back then. But this system didn’t exist, so financial institutions had to go through the hustle of digging deep to get full details of all the bankrupt entities they had done business with.

Need for a reliable system to fix the 2008 mess

Before introducing the GLEIS, over 50 major entity identifiers systems were being used by different authorities in different countries. The challenge with these many systems is that they were too simple; a regulator would just issue an identifier with lightweight infrastructure supporting its use.

Such systems are not reliable when it comes to identifying entities on a global scale. That is why there was a need for a worldwide legal entity identification system that every authority could rely on. A solution was finally agreed upon in 2011 when member states of the G20 called the Financial Stability Board (FSB) to recommend a Global Legal Entity Identifier and its supporting governance structure.

In 2012, the GLEIS officially launched, and the process of issuing unique legal entity identifiers was kick-started. An LEI number is simply a 20-character alphanumeric code that was created to help identify legal entities involved in the various international financial markets. With this system, it has become easier to answer the questions “who is who” and “who owns whom”.

Benefits of the GLEIS

It eases identification

The main reason why this system was created was to make it easier for businesses and regulators to identify the various entities involved in the global financial market. With this system, entities can know the business partners they are working with by simply searching for their details on the GLEIS foundation website.

There are over 39 Local Operating Units that are authorized to issue LEI numbers. These units have to do all the due diligence regarding the information submitted by the various companies to make sure it is correct.

To reduce risk

Doing business with an entity you can’t quickly identify is very risky. Every business needs to have a clear starting point in case anything goes wrong while transacting with another entity on the global market. An LEI is currently the most reliable identifier that businesses can rely on to get more details about the entities they are dealing with, just in case something goes wrong.

To eliminate scammers

If you have used the internet for a couple of years, I’m sure you have encountered several scammers that want to go away with your hard-earned cash without offering any product or service. With the GLEIS, it is straightforward to identify “who is who” and “who owns whom.” All this information is freely available for anyone to access on GLEIS Foundation’s website.

Consumers should also be very vigilant about the online businesses they trust. If an entity doesn’t have an LEI number, trusting it with your money shouldn’t be an option.

To enhance digital transformation

As more and more businesses continue to embrace the idea of digital transformation, the need to easily identify entities on the international market becomes crucial than ever before. With the GLEIS, it is pretty easy to know the entities you are dealing with by simply searching GLEIS’ website. There is also an API that websites and web apps can integrate into their systems to avail all the required LEI information whenever needed.

Bottom line

Having an LEI number is something that any legal entity should take seriously if they would like to operate legally in some of the biggest international financial markets, including the US, UK, and EU member states. This system of identification is currently the most reliable one that everyone around the world can trust.